About Shadhin Fintech Solution Ltd in Bangladesh

Shadhin is a Fintech solution in Bangladesh founded in 2018 with a mission to make financial inclusion a viable solution, Shadhin is working every day. By leveraging technology and following rigorous credit underwriting standards Shadhin is serving low and medium-income groups and underbanked people.

A group of young, dynamic professionals from various fields like investment banking, consulting, technology, e-commerce, and start-up management have come together to revolutionize the personal finance industry in Bangladesh.

Shadhin Sustainable Livelihood Trust is a registered society under the Bangladesh Society Registration Act of 1860. Its objective is to provide microfinance lending solutions to the average Bangladeshi. The organization is governed by the MRA Act of 2006.

Company Vision

The overarching goal for Shadhin Fintech is to be a community-based Financial Well-Being Company with the primary goal of Improving the Financial Health and Knowledge of all Bangladeshis. They focus on 3 key areas within Financial Well-Being:

1) Financial Access,

2) Financial Advice, and

3) Financial Education

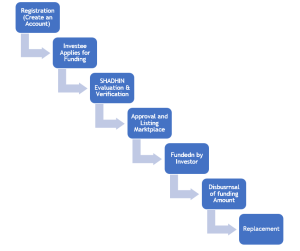

Shadhin does the heavy lifting – profile verification, due diligence, verification, legal documentation, monitoring, and collections.

Research Approach & Methodology

Research Objectives

This assignment’s main goal is to evaluate the “Shadhin Fintech Solution Limited” project through on-site visits to the project implementation sites in close coordination and collaboration with the Bhalo project management team and the UNDP CO-A2i Bangladesh team.

Research approaches

Integrated Research Methods have been applied to conduct the study. The data has been collected from both primary & secondary sources. The quantitative research approach has been applied for collecting the primary data by using the face-to-face survey tool and an on-site observation tool was applied to verify the income-generating activities of the beneficiaries of Shadhin Fintech Solution Ltd. Shadhin project

documents have been checked & verified by the accessor from both sides of the Shadhin project office as well as from the end-level beneficiary.

-

Quantitative Survey Method

Face to Face (F2F) survey tool has been applied through a quantitative research approach for collecting the primary data from the end-level beneficiary (farmers). The PAPI method was applied to conduct the interview & data acquisition.

-

On Sight Assessment & Office Visit

The sight Assessment tool has been applied to get deep information about the activities & engagement of Shadhin Fintech Solution Ltd with the end-level beneficiaries of the project. The business process & loan value chain of Shadhin Fintech Solution Ltd has been observed & assessed by the assessor through on sight Assessment tool.

-

Group Discussion

The project head office and project locations held informal group discussions among project staff and beneficiaries. The purpose of these discussions was to cover topics such as project rules, regulations, norms, compliance, and business procedures. The information gathered during these discussions was checked and verified by all participants involved.

Document Review: The Shadhin project documents were reviewed in order to establish the business process and ensure compliance between the end-level beneficiaries and Shadhin Fintech Solution Ltd. Both parties, including the Shadhin local agent office and the end-level beneficiaries, have reviewed and checked these documents. The documents of Shadhin agents were also reviewed by them.

Geographical Coverage

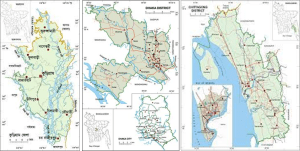

The major locations that have been coved are Kurigram & Ulipur upazila of Kurigram District, Chattagram metro area, and Dhaka metro area. The following maps show the covering locations in the study.

| Geographical Coverage | Covering Sample Size | |

| Kurigram | : | 19 |

| Dhaka | : | 6 |

| Chattagram | : | 16 |

| Total Sample Size | 41 |

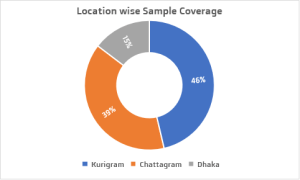

Primary Survey Outcomes

Basically, Shadhin Fintech Solution Ltd has been introduced in three districts of Bangladesh namely Kurigram, Dhaka, and Chattagram. We have focused on Kurigram Sadar and Ulipur Upazila in Kurigram district, where we have collected around 46% samples. Similarly, we have covered approximately 39% of the samples in the Chattagram metropolitan area and around 15% in the Dhaka metropolitan area. The pie chart provided below depicts the geographical coverage of our assessment.

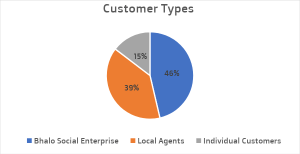

Covering Sample Types

In conclusion, Shadhin Fintech Solution Ltd in Bangladesh works with existing customers in Kurigram through Bhalo Social Enterprise (46%), Chattagram with local agents (39%), and individuals applying for loans through online and mobile apps (15%). They share profit revenue with Bhalo Social Enterprise and operate loan management and operations in their project execution area.

For more details, please Contact Us.

or, WhatsApp Us: +880 1713222363