Lead-acid Battery Industry in Bangladesh

The Business Standard estimates that the value of the lead-acid battery industry in Bangladesh is around BDT 10,000 crore. In the last decade, the industry has grown three to four times in size, according to the Business Post. The market participants may generate about 40 lakh batteries a year, depending on their production capability.

Founded in 1954, Rahimafrooz Group is the industry pioneer in the local lead-acid battery sector. In 1985, the company began manufacturing industrial batteries. Rahimafrooz Batteries Limited is currently the leading producer of lead-acid batteries in the nation, manufacturing 200 varieties of batteries for a range of uses.

The Rahimafrooz Group also includes Rahimafrooz Globatt Limited and Rahimafrooz Accumulators Limited as two additional companies. These companies manufacture specialty batteries for use in automobiles and machinery. In addition, there are about 25 domestic producers in Bangladesh that make batteries for systems including solar panels, simple bikes, battery-powered rickshaws, commercial vehicles, passenger transportation, IPS and UPS systems, telecommunication towers, and more. Several well-known brands in Bangladesh’s lead-acid battery manufacturing sector include Navana, Hamko, Panna, General, Rimso, Rangs, and others. Over one lakh individuals have been directly or indirectly employed by the sector.

According to a report by Mordor Intelligence, the lead-acid battery market in Bangladesh is anticipated to grow at a Compound Annual Growth Rate (CAGR) of above 3% between 2022 and 2027. The lead-acid battery industry’s growth is anticipated to slow due to the falling cost of lithium batteries and the growing popularity of electric vehicles, which rely heavily on lithium batteries.

Market scenario in Bangladesh

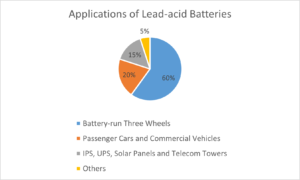

In the context of Bangladesh, the major portion of the demand for lead-acid batteries comes from battery-run three-wheelers, which are known as easy bikes. Battery-run rickshaws also fall into this category. A report by The Business Standard states that the number of easy-bikes on the streets of Bangladesh has already exceeded 30 lakhs. As policymakers are planning to regularize this mode of transport with the introduction of safer designs of vehicles and licensing procedures, the number of easy-bikes and battery-run rickshaws will go up in the future. These three-wheelers currently use almost 60% of the lead-acid batteries made in the nation, according to an industry expert.

In addition, easy bikes typically need five lead-acid batteries to operate, and these batteries have a lifespan of less than a year, resulting in recurring sales for the lead-acid battery manufacturers, 20% of the whole battery demand. However, telecommunication towers, solar panels, UPSs, IPS, and other devices make up about 15% of the overall demand. The remaining 5% is used for additional unique functions.

Background of study

The electric rickshaws or E-Rickshaws have been creating a remarkable demand for short-trip travel in urban, semi-urban & rural areas across the country. These rickshaws have been popular due to reducing the physical labor & energy of the pullers & the drivers. In Bangladesh, there are two types of e-rickshaws. The first one is the newly designed & factory-manufactured products, which are being imported mainly from China & some from India. These rickshaws are commonly known as “Easy bike,” “Tomtom” etc. On the other hand, there is another category of electric rickshaw which is not newly designed & factory manufactured, but these are modified versions of local/Bangla rickshaw for passenger transport & Bangla van for goods carrying. These types of e-rickshaws are well known as Electric Vehicles or EVs in Bangladesh.

There are about 5-7 lacs EVs running in Bangladesh & all these types of vehicles are three-wheelers powered by an electric motor ranging from 650-1400 watts. Currently, two types of batteries are being used in these EVs. First one is VRLA DMZ in traditional modified rickshaws & van, and the second one is Low maintenance (LM ER) Battery as a modified setup up a manufactured in-built.

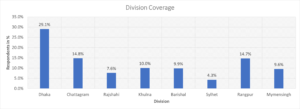

We have covered 8 divisions, and 29.1% of respondents are covered from Dhaka

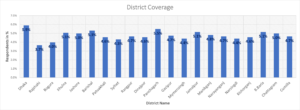

We have gathered primary data from eight divisions throughout the nation. The divisions of Dhaka accounted for around 29.1% of the respondents, followed by Chittagong (14.8%), Rajshahi (7.6%), Khulna (10.0%), Barishal (9.9%), Sylhet (4.3%), Rangpur (14.7%), and Mymensingh (9.6%).

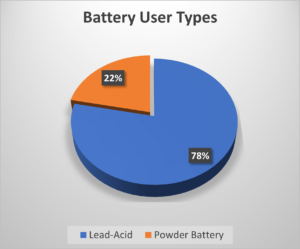

Lead Acid Users

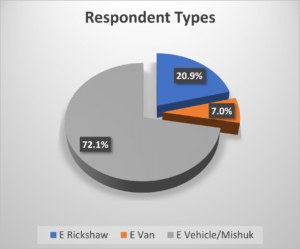

We covered the most E vehicle/Mishuk [72.1%] among all respondents, followed by E Rickshaw [20.9%] and E Van [7.0%]. There were 1204 people in the basic sample overall.

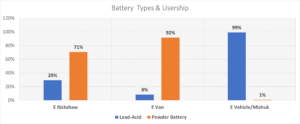

Powder Battery (ER, EV, and Lead Acid) for E Vehicle/Mishuk

- E-Rickshaw & E-Van are using mostly Powder Battery 71% & 92% respectively

- E-Vehicles/Mishuk are using mostly Lead Acid Battery (99%)

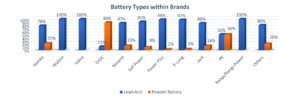

Battery types-wise Brand Share

Most companies are manufacturing lead-acid batteries except for DJDC. They have the maximum market share on Powder battery (89%). On the other hand, Hamko has 22%, Navana 13%, Jack 14%, PK 50%, Saif Power 9%, Power Plus 2%, E-Long 3% & Others 20% market share on Powder Battery. The rest are Lead Acid Battery like Hamko 78%, Walton 100%, Volvo 100%, DJDC 11%, Navana 87%, Saif Power 91%, Power Plus 98%, E-Long 97%, Jack 86%, PK 50%, Rangs 100% & others 80%.

For more information or if you have any queries about market and social research, please contact us …