The bakery and confectionery industry in Bangladesh has become almost self-sufficient in meeting local demand, thanks to entrepreneurs who have invested heavily to produce quality items and import substitutes. Industry sources claim that the sector has already established itself in the global market and drawn more local investors, especially big corporations, to fund the venture. Less than 4.0 percent of the products in this category, particularly high-end items mostly used by the middle and upper middle classes, are now imported, according to the source.

They claim that the automated confectionary and bakery businesses have steadily taken over the local market, displacing the conventional businesses, which are currently having difficulty surviving in the face of fierce competition. Industry insiders estimate that over the last two decades, the top conglomerates have taken over 60% of the market.

Major Products

- Cakes and pastries

- Cream-based desserts

- Chocolate products

- Dairy-based desserts

- Dough and batter

- Frostings and icings

- Freshly baked goods

- Cookies

- Crackers and biscuits

- Dry cakes

- Breadsticks and pretzels

- Shelf-stable pastries

- Candies

- Shelf-stable chocolate bars

Market Overview

Bangladesh’s GDP has grown at an average pace of 6% during the last ten years, which is impressive. Bangladesh’s economy now ranks 41st in the world, but if current growth trends continue, it is expected to rise to the 24th rank. Infrastructure investments, the growing middle class, and the pace of urbanization are the main causes of this relevant growth.

By 2040, the pace of urbanization is predicted to have increased from 39% in 2021 to 50%. The population shift from rural to urban areas has led to a decrease in joint families and an increase in nuclear families, which has raised the demand for consumer goods at the home level. It has also led to a rise in the demand for food in general and bakery goods in particular.

The population’s exploration of various cuisines has resulted in the invention of bakery items, which have been made possible in large part by the capacity expansion of well-known local brands, a greater trend towards automation, and the upholding of quality standards.

Additionally, the chance to experiment with novel flavors in the baking business has been made easier by the rise in industrial manufacturers and boutique bakeries. The industry has been able to sustain a growth rate of 10% to 12% due to its varied product range, which also includes items that are well-known in international markets, hence improving the sector’s export possibilities.

Key Players

| MITHAI SWEETS |  |

| BONOFUL SWEETS |  |

| MEENA SWEETS | |

| FUWANG FOOD LTD |  |

| PRAN-RFL |  |

| DAN CAKE |  |

| FULKOLI SWEETS & CONFECTIONARY |  |

| AKIJ BAKERS LIMITED |  |

| MR. BAKER (CAKE & PASTRY) |  |

| AJWAH (BAKE & PASTRY) |  |

| HAQUE BAKERY | |

| OLYMPIC INDUSTRIES LTD |

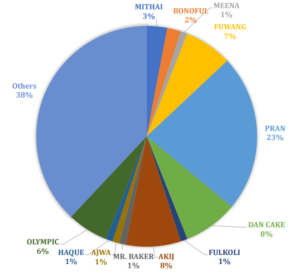

Market Players and Share of the Industry

For more information or any market or social research-related queries, please contact us…