Bangladesh is undergoing rapid infrastructure development, particularly in rural areas, driven by the demand for sustainable building materials. The traditional use of red bricks in construction has posed environmental challenges, prompting a shift towards alternative building materials such as concrete blocks, fly ash bricks, and other sustainable options. This situation explores the transition from conventional red bricks to these sustainable alternatives in line with Sustainable Development Goal (SDG) number 9 – Industry, Innovation, and Infrastructure.

Currently, Bangladesh faces a significant demand-supply gap in building materials, especially red bricks. Recent surveys indicate a total demand of approximately 23 billion bricks annually, while sustainable block manufacturers can supply only around 2 billion. To address environmental concerns and meet growing construction needs, the government has taken steps to phase out traditional red brick production, resulting in the closure of approximately 500 conventional brick kilns.

The Ministry of Environment, Forest, and Climate Change of the People’s Republic of Bangladesh has completely banned the use of burnt clay red bricks in all new activities of the PWD (Public Works Department) since August 2022. In place of these bricks, there are clear instructions to use eco-friendly materials such as eco-bricks, blocks, hollow blocks, or similar materials. Notably, PWD generally emphasizes the use of eco-friendly, sustainable, and durable blocks.

Material Diversification on Building Wall Solution

- Promote Sustainable Alternatives: Encourage the adoption of sustainable building materials like concrete blocks, fly ash bricks, and other eco-friendly alternatives to reduce reliance on conventional red bricks.

- Support Rural Development: Enhance rural infrastructure development through the use of sustainable building materials, fostering economic growth, and improving living standards.

- Achieve SDG Goal 9: Contribute to SDG 9 by promoting industry, innovation, and infrastructure through the adoption of modern building technologies that reduce environmental impact.

- Environmental Considerations: AAC blocks and other alternatives are preferred due to their lower environmental impact compared to conventional red bricks, which contribute significantly to deforestation and air pollution through brick kilns.

- Cost Efficiency: These blocks offer cost savings in construction due to their lighter weight, which reduces transportation costs and faster construction times, leading to overall project cost reductions.

- Durability and Strength: AAC blocks and other alternatives often boast superior strength and durability, providing better resilience against natural disasters such as earthquakes and floods, which are crucial factors in disaster-prone regions like Bangladesh.

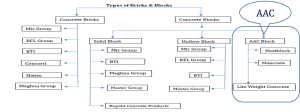

Types of Concrete Blocks, Bricks & Key Players

There are several types of Concrete Blocks available in the market, which are being applied for exterior & interior wall solutions in buildings. AAC Block is the newcomer in the construction industry. Three major 3 key players are available in the market that manufacture the product.

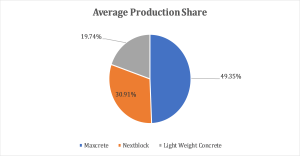

AAC Block Average Production Capacity & Share

| Key Players | Average Production Capacity (Cub. M) |

| Maxcrete | 250000 |

| Nextblock | 156600 |

| Lightweight Concrete | 100000 |

| Total Unit | 506,600 |

The primary discussion with the major key players of AAC Block manufacturers revealed that a total of 3 companies manufacture AAC Blocks. Among them, Nextblock is the largest based on current manufacturing capacity (156600 Cub M), followed by Maxcrete (1000 Cub M per day) and Light Weight Concrete (500 Cub M per day). We consider 290 days full capacity production at Nextblock, average 250 days production with full capacity at Maxcrete and average 200 days production with cull capacity at Light Weight Concrete.

Based on the primary data on production capacity, the analysis found that Maxcrete occupies most of the production capacity, which is 49.35% of total production. Whereas, Nextblock occupied 30.91% and Light Weight Concrete occupied 19.74% of the total production capacity. The production capacity has been considered annually.

Average production share of the key players

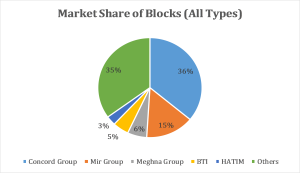

Types of Concrete Blocks, Bricks & Key Players

Different types of blocks and concrete products are used in wall solutions in the building as part of AAC blocks. In this aspect, we can consider these products as competitors of AAC Blocks. Most construction companies use Concrete Blocks and Bricks as in-house raw materials. By considering all types of block products, the entire market size in Bangladesh is about BDT 200 Crore, in which Hollow Block and Concrete Bricks are the major products. There are also Concrete blocks, Solid blocks, pavement blocks and some other similar products.

| Key Players | Market Share in % |

| Concord Group | 36% |

| Mir Group | 15% |

| Meghna Group | 6% |

| BTI | 5% |

| HATIM | 3% |

| Others | 35% |

| Total | 100% |

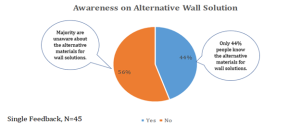

Customers’ Awareness of Alternative Wall Solution

We have asked the potential respondents about their Awareness of the Alternative Wall Solution. Researchers found that the maximum respondents don’t know about alternative wall solutions for the building. Only 44% respondents are aware of alternative wall solution materials, while 56% respondents don’t know about it.

For more information, please contact us …