The global feed industry is valued at around USD 400 billion per year. There are more than 31,000 feed mill companies operating worldwide. As of today, the total global feed production capacity is about 980 million tons per year. In Asia alone, there are about 13,736 feed manufacturers with a combined annual capacity of 350 million tonnes. Therefore, Asia plays a major role in the global feed business.

Bangladesh is a small country in Asia. However, the government is gradually expanding the size and economic scope of its feed milling industry. The total investment in the poultry sector is now more than BDT 5,000 crore. Farmers have established over 130,000 poultry farms in rural areas across the country. This continuous growth creates new employment opportunities for rural people. At present, about 6,000,000 people are directly or indirectly involved in the poultry sector for their livelihood.

The cattle, fishery, and poultry industries play an important role in Bangladesh’s agro-based economic growth. These sectors contribute around 32% of agricultural income and about 8% of national GDP. Fish and cattle supply nearly 80% of animal protein in the national diet. The poultry sector is also a major source of animal protein. It supplies affordable meat and eggs. As a result, poultry accounts for around 20% of total protein consumption in Bangladesh. Even so, there is still a gap between the supply and demand of chicken meat and eggs due to population growth.

Current Poultry Farming Scenario in Bangladesh

Bangladesh’s poultry industry has expanded rapidly over the past few decades. The sector has shifted from small backyard farming to modern commercial production systems. Commercial poultry farms are now increasing at an average rate of 15% per year. Because of this growth, the industry currently generates employment for around 8 million people. In addition, about 1 million entrepreneurs are directly involved in poultry business operations. As a result, the country produces around 23.37 billion eggs and 1.46 million tons of poultry meat every year.

Technological advancement has also supported this transformation. High-yield poultry breeds and improved breeding techniques have increased production efficiency. In addition, modern feed formulation and nutrition management systems have improved feed conversion ratios. Therefore, flocks are becoming healthier and production rates are increasing steadily. According to the Feed Industry Association Bangladesh, the livestock and aquaculture feed market (both legal and informal) reached over 8 million metric tons in 2023. This shows that feed demand is rising continuously alongside the growth of poultry farming.

Types of Poultry Feed in Bangladesh

Poultry feed contains a mix of grains, protein sources, minerals, and supplements. In Bangladesh, most commercial feed mills and small farms use different combinations based on availability, price, and production goals.

Wheat is one of the most common grains for poultry feed. It can be fed whole or used in mash form. During the rust or frost seasons, farmers grind more wheat and include it in mash instead of using it in scratch feed.

Oats are also used in poultry diets. However, their feeding value depends on the thickness of the hull. When oats have too much husk, the quality becomes poor. Oats can be fed whole or in ground form.

Barley is used in scratch feed and mash mixtures. It is slightly less palatable than wheat or oats. Still, when wheat and oats are expensive or of low quality, barley becomes a good alternative.

Corn is one of the most desirable grain crops globally. It can be fed whole, broken, or ground. Corn is also used widely in dry mash rations. Proper drying is important to prevent spoilage.

Millet performs well in laying, growing, and fattening rations. It can form up to one-third of the whole grain portion of the diet.

Rye is less palatable than wheat, oats, and barley. It should be fed in limited quantities because large amounts may cause digestive problems.

Flaxseed is rich in protein and fat. A small quantity is useful during moulting, winter, and early laying periods. Linseed oil cake is also used as a protein source.

Grain by-products like bran, shorts, middlings, and barley meal are useful when feed mills need specific nutrient adjustments. These are often used in growing, laying, or fattening rations.

Skim milk and buttermilk are excellent protein supplements. They are highly beneficial for chicks, layers, and fattening birds. Milk is a good source of riboflavin, which improves egg hatchability.

Commercial concentrates are manufactured balancers. Feed companies recommend the correct inclusion rates. Farmers mix these with local grains to improve protein and vitamin levels.

Fish oil is used mainly in winter or when sunlight is limited. It is a rich source of vitamins A and D, which support growth and egg production.

In Bangladesh, poultry feed depends highly on imported soybean and soybean meal. Meat and egg consumption per capita is still lower than the FAO recommendation. Additionally, disease outbreaks like Avian Influenza continue to affect both poultry production and feed industry growth.

Major Feed Manufacturers in Bangladesh

There are approximately 78 feed manufacturing companies operating in Bangladesh at present. These companies produce readymade feed products for poultry, fish, and cattle. Most of these manufacturers supply feed mainly to the local market. However, a few producers manufacture feed only for their own farms and do not sell commercially.

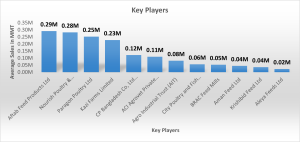

The last three months’ sales data identifies several companies as the major key players. These companies consistently record higher sales volume compared to small producers. Their strong distribution networks, brand recognition, and supply capacity help them maintain a stable market position in the livestock feed industry.

Feed Distribution Channels in Bangladesh

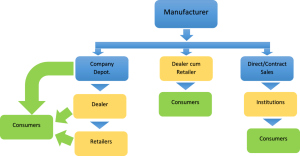

Poultry, fish, and cattle feed products reach consumers through several different distribution channels. In Bangladesh, companies use three main distribution channels. First, they stock feed in their company depots. Then they supply this feed to dealers and retailers. Finally, these sellers deliver the feed directly to farmers.

The second channel is dealer–cum–retailer distribution, where the dealer plays a dual role. In this case, the dealer works as both a distributor and a retailer. This structure helps manufacturers cover more market areas with lower operational costs.

The third channel is direct or contract sales. Many feed manufacturers have their own direct sales teams. These teams supply feed products directly to commercial farms and contractual consumers. As a result, commercial farms can maintain a stable feed supply without depending on retail outlets.

Product Supply vs Market Demand

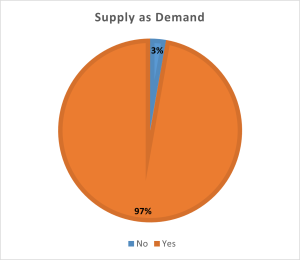

Most traders reported that feed companies are able to supply products according to their regular demand. Based on the survey findings, 97% of respondents stated that they receive the required products properly from different manufacturers. However, the remaining 3% mentioned that they do not receive products as per demand. According to them, the lack of supply happens mainly due to transportation delays, climatic interruptions, and political disruptions.

The pie chart below presents the supply status based on trader feedback.

For more information, please contact us …