The dairy sector has continued to grow steadily despite several recent economic setbacks.

Over time, the dairy sector in Bangladesh has grown from its modest beginnings into a large and vital industry. Today, numerous dairy farms operate across the country. The industry serves both as an important food source and as a key means of livelihood for many rural families. It has the potential to significantly impact the nation’s economic growth.

In recent years, the sector has expanded rapidly. Innovation and new technologies have improved milk production, market access, and overall sustainability. These developments are helping farmers become more efficient and competitive.

The value chain of the dairy industry can be divided into two main models: the formal processed market and the informal traditional market. According to a survey by the International Farm Comparison Network, only about 9% of milk is supplied to industrial processors, while nearly 91% is sold through informal channels.

In the informal system, farmers sell milk directly to consumers. In contrast, the formal market follows a cooperative model. Here, farmers form cooperatives that collect and distribute milk to industrial facilities. These facilities then process and sell the products to consumers.

Automation plays an important role in the formal segment. It helps in collecting and processing milk, as well as producing end products. This process increases efficiency, reduces costs, and supports large-scale operations.

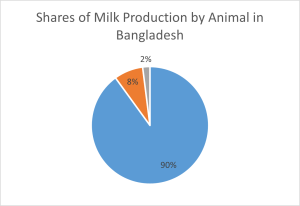

As mentioned earlier, traditional channels still dominate the dairy industry in Bangladesh. Cows are the main source of milk production, providing around 90% of the total milk produced by farmers.

The formal value chain accounts for only 9% of total milk output; however, it remains the most effective model for increasing the production of value-added products. As a result, industrial milk processors are shifting their collection points closer to production areas, since milk is highly sensitive to temperature and storage time. Moreover, as consumers are increasingly concerned about quality and freshness, this approach helps meet their expectations. In addition, advanced refrigeration systems and milk testing equipment at these collection centers enable dairy producers to receive payment based on the fat content of their milk.

Large volumes of foreign milk powder are entering the local market because there is a large imbalance between supply and demand, which is filled with various imported dairy products. However, slow progress has been noted despite the government’s strong encouragement of the local dairy industry’s expansion. As a result, the nation has become more reliant on imported milk powders in recent years due to rising domestic consumption and industrial demand. Therefore, as long as local goods remain reasonably priced, increasing domestic milk production can help reduce reliance on imports.

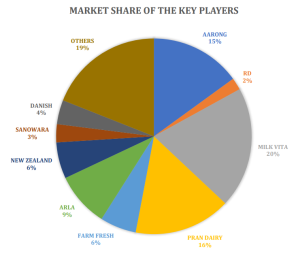

Major Key Players

| 1. AARONG Dairies (BRAC) |  |

| 2. RD (Rangpur Dairy) | |

| 3. Milk Vita |  |

| 4. Pran Dairy |  |

| 5. Farm Fresh Milk (Akij Dairy) |  |

| 6. Arla Foods Ltd | |

| 7. New Zealand Dairy |  |

| 8. SANOWARA Dairy Foods Limited |  |

| 9. Danish Dairy Farm Ltd (Partex Group) |

Current Market Players and Their Share

Major industrial processors such as Milk Vita, Aarong Dairy, and PRAN control over half of the processed dairy product industry. The primary target consumers are predominantly urban consumers who desire a wide selection of brands, qualities, and products. People can access processed goods via retail stores, supermarkets, restaurants, and hotels.

For more information, or if you have any research-related questions, please contact us…