A super shop is a self-serve store with many different foods, drinks, and home goods arranged into departments. One of Bangladesh’s expanding industries is the superstore sector. Super shop’s expansion was accelerated by the nation’s urbanization, socioeconomic growth, and rising middle- and upper-class purchasing power.

The super shop business started in the country after 2000, and it took more than a decade to gain public acceptance. In 2001, Rahimafrooz Superstores Ltd. opened “Agora,” Bangladesh’s first superstore, adopting a Western idea. Rahimafrooz Superstores Ltd. established this supermarket. The “Gemcon group” introduced “Meena Bazar” the next year. “Shwapno” began operations in Bangladesh in 2006 as a sister company of ACI Limited. With more than 185 locations and 40,000 daily consumers, “Swapno” is now the largest supershop chain in Bangladesh in terms of the number of outlets. Nevertheless, out of all of Shwapno’s locations, 61 are under the company’s ownership; the remaining locations are run by franchises. Additionally, Rahimafrooz’s Agora has eighteen sites nationwide, while the Gemcon Group’s “Meena Bazar” has eighteen outlets in Dhaka, Chittagong, and Sylhet.

Gemcon Group and Rahimafrooz were reportedly in talks to acquire all “Agora” locations, according to a 2020 Daily Star story. In addition, United Group’s “Unimart” has two express locations at United Hospital and United International University, three locations in Dhaka at Gulshan, Dhanmondi, and Wari. Conversely, the Pran-RFL Group operates 51 Daily Shopping locations in Dhaka. Aside from this, Dhaka is home to a few more small superstore chains, such as two Prince Bazar stores and four Almas stores. The majority of the super shop retail locations can be found in major cities like Rajshahi, Sylhet, Chittagong, Dhaka, and Narayanganj.

Business Model

The business structures and revenue creation of supermarkets are heavily dependent on global product sales. Supermarkets then frequently purchase goods from both main and secondary sources. If supermarkets buy products straight from the manufacturer, without the need for an intermediary, they can do it at a reduced cost. Conversely, the price of buying the same quantity of goods increases because of middlemen. Super shops, on the other hand, are able to purchase goods in bulk for all of their outlets and have greater purchasing power than supermarkets. Superstores may therefore be able to purchase goods at a lower wholesale price than small retail establishments or grocery stores, even in the case of several intermediaries. As a result, supermarkets may generate more revenue at larger margins than small retail or food stores.

Supermarkets provide products with varying profit margins. Some local products can make less than 5% profit, whereas some imported products can make up to 50% profit, according to one market analysis. Superstores typically generate a profit margin of 15% to 16% of their total sales. To boost revenue, many of them rely on “bundle pricing,” a popular retail strategy. By bundling fast-moving items with slower ones at a discounted rate, superstores can effectively clear old inventory while attracting more customers. Moreover, supermarkets provide “buy one, get one free” deals on a few products. Super stores are able to increase sales volume and make significant profit margins by using this strategy.

Key Players’ Country of Origin

| 1. SHWAPNO |  |

| 2. AGORA | |

| 3. MINA BAZAR | |

| 4. CSD BANGLADESH |  |

| 5. PRINCE BAZAR |  |

| 6. DAILY SHOPPING |  |

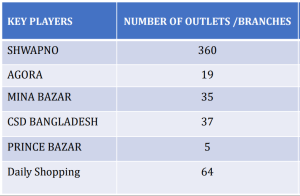

Super Shop Branch Count

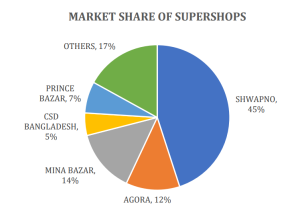

Market Share of Super Shops

Major products of this segment

- Frozen chicken, fish, red meat & poultry

- All types of dairy items

- Read to cook food (Frozen food)

- Confectionery Items

- Fruits & Vegetables

- Different types of masala & spices

- Fresh vegetables

- Dry items like coffee beans, nuts

- Live fish & chicken

- All types of grocery items

Rising Purchasing Power and Growing Market Demand

The purchasing power of the people in Bangladesh is rising daily. As per capita income climbed to USD 2227 this year from USD 2064, we may conclude that people’s disposable income is rising along with the desire of middle-class and upper-class consumers to make all of their purchases in one location. Consequently, there is a growing need for big stores across the nation. A study by Business Standard states that supershops will be constructed in all of Bangladesh’s district headquarters and suburban districts in order to accommodate the growing demand in the next five to ten years. Another TBS news article states that whereas Shwapno is expected to rise by 20% annually, typical cooking market sales are expected to grow by only 5–6% annually. This suggests that customers are shifting from traditional retail markets to super shops. Super Shop thus has a great deal of room to grow.

Global Retail Trends and Opportunities for Bangladesh

Super shops are relatively new in Bangladesh; however, in several wealthy nations, they are well-established. The biggest retail companies in the world will be drawn to Bangladesh if this industry grows successfully there. The superstore industry in Bangladesh would grow along with the size of the country’s overall retail market if these retail behemoths were to set up shop there. Traditional retail establishments are still in business, despite the global retail behemoths’ slow transition to e-commerce. Despite being an online retailer, Amazon is conducting research for in-store grocery item sales, employing a variety of cutting-edge technologies in physical locations. As a result, because they can service both offline and online platforms, they will be able to serve a larger number of clients.

Future Growth Potential for Super Shops

Even if there aren’t enough super stores in Bangladesh, there is a lot of room for expansion because super store chains are expanding, consumer demand is shifting, and overhead revenues are rising. Superstores have altered the nation’s purchasing habits and customer service during the past 19 years. Superstore growth may have been faster if government organizations such as tax authorities and regulators had enforced equal chances and fair laws.