The medical equipment industry in Bangladesh is growing fast. The market is changing quickly because hospitals need more modern healthcare solutions. The nation’s healthcare system now receives more attention. As a result, demand for medical devices has increased. These devices include surgical instruments, diagnostic tools and other essential medical equipment. A growing middle class, more healthcare awareness, and population growth are all driving forces behind this market’s expansion.

Bangladesh’s expanding population required more and more imported medical supplies for many years. This was a result of multiple things. First off, there was no indigenous medical equipment production capacity. Bangladesh lacked the infrastructure and skilled labor required for local manufacturing due to little investment in this area and a lack of technical know-how. Second, foreign aid was the main source of funding for healthcare in the past. Donor agencies often supplied medical equipment as part of their support. This approach did improve access. However, it also made the system dependent on external decisions. As a result, Bangladesh had less control over the type and quality of the equipment it received.

The excessive reliance on imports brought about a number of noteworthy difficulties. The main issue was the expensive equipment. The high cost of imported devices put pressure on both government healthcare budgets and patients. Many people struggled to pay for important diagnostic tests and treatments. In addition, the import equipment procurement process may need to be more convenient and drawn out, which could cause delays in the acquisition of essential instruments. This affected patient outcomes in the end as well as the effectiveness of healthcare delivery. The restricted availability of spare parts and maintenance services for imported equipment exacerbated these issues and further jeopardized the long-term dependability and functionality of these systems.

Factors Driving Growth

Acknowledging the drawbacks of depending exclusively on imports, Bangladesh has instituted a multifaceted strategy to promote the expansion of its indigenous medical equipment sector. Several government programs now lead this effort. They aim to create a supportive environment for local producers. Among these attempts are adjustments to policies that offer substantial benefits to businesses looking to invest in home manufacturing. In order to draw in investors, special economic zones with simplified regulatory processes and tax benefits have been created.

Furthermore, the government has given medical equipment research and development (R&D) top priority, emphasizing solutions that cater to the unique requirements of the Bangladeshi populace. This emphasis on regional R&D encourages creativity and guarantees that equipment made in the nation is not only reasonably priced but also well-suited to the particular healthcare needs of the nation.

Investing in the development of human capital is another essential component that propels progress. Acknowledging the need for a trained labor force, the government has started training programs for engineers, technicians, and other medical equipment sector specialists in partnership with academic institutions and commercial businesses. These courses give students the technical know-how and proficiency needed for a variety of design, production, and maintenance tasks. Additionally, partnerships with foreign organizations promote information sharing and introduce Bangladeshi specialists to the newest developments in medical equipment technology.

The advancement of the industry has also been greatly aided by the private sector. Growing investment, both domestically and internationally, has supplied the capital required to set up manufacturing facilities and purchase state-of-the-art technologies. Private businesses regularly engage in research and development, concentrating on creative and affordable solutions to satisfy regional market demands. This culture of entrepreneurship is creating a dynamic and competitive atmosphere that will eventually improve the affordability and quality of medical equipment made in the United States.

Market Overview

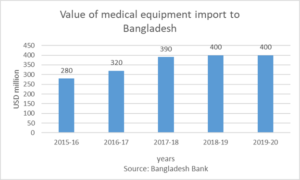

The medical equipment and device industry in Bangladesh is still young. Imports supply around 85% of all devices. The market was valued at USD 442 million in June 2020. With a CAGR of 13%, it could reach over USD 820 million in 2025.

There are around 4,000 medical devices in use in the country. Only 5% to 7% are made locally. Most locally produced items are consumables. These include needles, blood bags, transfusion sets, cannulas, precision syringes, and blood collection tubes. The annual market for consumables in Bangladesh is around USD 55 to 60 million.

Bangladesh also makes some surgical sterilizers, hospital furniture, orthopedic items, and home care devices. Examples include bone hooks, drill machines, spine retractors, blood pressure monitors, glucose monitors, compressor nebulizers, ECG paper and other small tools. However, these are made on a smaller scale.

The COVID-19 pandemic increased local production of PPE. Local factories now make respirators, gowns, protective masks and protective clothing. However, USAID reports that Bangladesh still depends on imports for 85% of its medical equipment needs by value. In FY 2019-20, imports exceeded USD 400 million. Rising disease rates are also increasing demand for ECG machines, stents and medical balloons.

Bangladesh still imports high-end devices such as MRI, X-ray, ultrasound and CT scanners. Local factories produce medium-priced ECG machines, but only in small volumes. Some of these locally made products are also exported. Bangladesh also shifted part of its ready-made garments capacity to produce PPE during COVID-19. Many factories expanded or converted production lines to meet global shortages.

Growth Potential

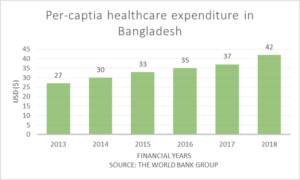

Bangladesh’s demand for healthcare services is predicted to rise sharply due to rising purchasing power. By 2025, the Boston Consulting Group projects that between 30 and 40 million individuals will have moved out of poverty and into the middle class, earning a higher quality of life. An additional 30 million people will do the same. The present low per-capita healthcare spending in conjunction with the rising affordability points to potential future growth in the healthcare industry. Even though Bangladesh’s per-capita spending on healthcare services has been increasing at a CAGR of 9% since 2013, as of 2018, it is still just USD 42, which is low when compared to regional peers and suggests that healthcare spending may rise as income rises.

Medical Equipment Production

It is clear that the growth of healthcare facilities drives the demand for medical equipment. Bangladesh’s medical sector grew faster than any other country from 2016 to 2019. The annual growth rate was 14.6%. Business Monitor International Research also predicts that this growth will continue. As disease patterns shift toward NCDs, the demand for medical devices will rise. NCDs often require surgery and long-term treatment. Therefore, more devices will be needed in the future.

There is strong potential to expand local production of medical devices. At present, local manufacturing is still small and mainly covers low-risk products. However, local manufacturers now have a chance to focus on both domestic and export markets. They can also benefit from privileged export access to 52 countries.

Consumables & surgical instruments

As the number of healthcare providers increases, demand for disposable medical items will also grow. These items include safety syringes, needles, catheters, suturing kits, scalpels, scissors, bandages, gloves, masks and endotracheal tubes.

Equipment required in ICU/OT

Demand for ICU and OT equipment will rise as the number of healthcare facilities grows. This includes oxygen masks, ventilators, diathermy machines, OT lights, OT tables, ICU monitors and suction machines. In addition, demand for hospital furniture will also increase.

In-vitro diagnostics (IVD) equipment and diagnostic imaging

As diets and lifestyles change, non-communicable diseases (NCDs) will increase in Bangladesh. These include diabetes, cancer, heart disease and kidney disease. As a result, the demand for NCD screening, diagnosis, treatment and monitoring tools will rise. These tools include diagnostic imaging equipment, testing kits, laboratory devices and home monitoring tools.

For example, the World Bank Group (2019) reports that 9% of people have diabetes. This may increase local demand for insulin pens, glucose monitors and diabetic strips. Therefore, international investors may see an opportunity to support local production of these devices.

Health insurance

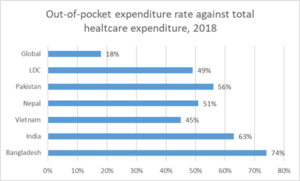

Households pay around 74% of total healthcare costs in Bangladesh. This is one of the highest out-of-pocket spending rates in the world. In addition, Swiss Re reported that Bangladesh had one of the lowest insurance penetration rates in Asia in 2018. The rate was only 0.6%. The government now plans to provide healthcare access for all by 2032. Therefore, the health insurance market in Bangladesh has strong room for growth. International investors have the chance to be heavily involved in the development of health insurance.

For more information, please get in touch with us…