-

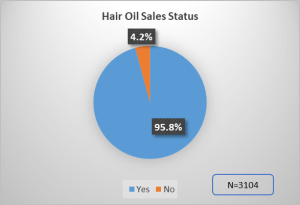

Hair Oil Sales Status

In a survey of 3104 outlets, the sales status of the Hair Oil market was investigated. Of the total respondents, approximately 95.8% (2974 individuals) reported that they regularly sell various types of Hair Oil. Only 4.2% (130 individuals) of respondents reported that they do not currently sell any kind of Hair Oil.

-

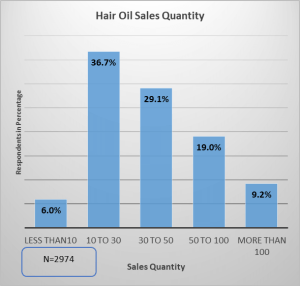

Hair Oil Sales Quantity

Among the total Hair Oil sellers (2974) we have asked about the average sales quantity of last month. Here is the respondent’s feedback that their average sales quantity is 15-25 pieces of different sizes (36.7% of 2974 respondents). However, approximately 29.1% of respondents replied that their average sales quantity is 30 to 50 pieces of different sizes. 19.0% of respondents replied that their average sales quantity is 50 to 100 pieces of different sizes. Approximately 9.2% of respondent’s sale quantity is more than 100 pieces of different sizes. Only 6.0% of respondent’s sales quantity is less than 10 pieces of different sizes.

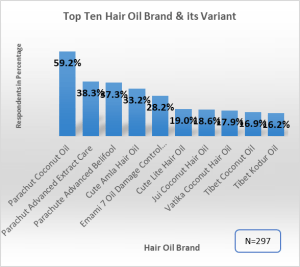

- Top Ten Hair Oil Brands & Its Variant:

To identify the top branded Hair Oil products, we have asked the respondents (total of 2974) about the most-selling brand.

Most respondents (59.2%) mentioned Parachute Coconut Oil as their top brand. Tibet Kodur Oil ranked tenth, with 16.2% of respondents choosing it. Other brands in the top ten include:

-

Parachute Advanced Extract Oil – 38.3%

-

Parachute Advanced Belifool – 37.3%

-

Cute Amla Hair Oil – 33.2%

-

Emami 7 Oil Damage Oil – 28.2%

-

Cute Lite Hair Oil – 19.0%

-

Jui Coconut Hair Oil – 18.6%

-

Vatika Coconut Hair Oil – 17.9%

-

Tibet Coconut Oil – 16.9%

-

-

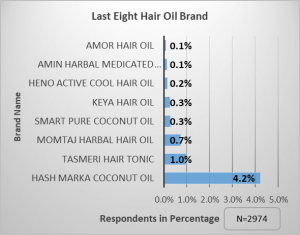

Last Eight Hair Oil Brands & Their Variant

We conducted a survey with 2,974 respondents to determine the least-selling brand among the last eight branded hair oils. Out of the total respondents, only 4.2% mentioned Hash Marka Coconut Oil as the first brand. The other brands, in descending order of mention, were Tasmeri Hair Tonic (1.0%), Momtaj Herbal Hair Oil (0.7%), Smart Pure Coconut Oil (0.3%), Keya Hair Oil (0.3%), Heno Active Cool Hair Oil (0.2%), Amin Herbal Medicated Oil (0.1%), and Amor Hair Oil (0.1%).

-

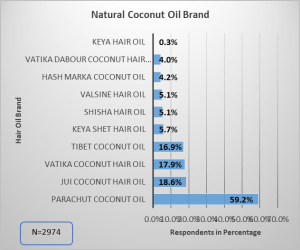

Natural Coconut Oil Brand

We conducted a survey with 2974 respondents to determine the most popular natural coconut oil brands. The results showed that 59.2% of respondents mentioned “Parachute Coconut Oil” as the top brand, while Keya Hair Oil ranked tenth with only 0.3% of mentions. Other brands mentioned include Jui Coconut Hair Oil (18.6%), Vatika Coconut Hair Oil (17.9%), Tibet Coconut Oil (16.9%), Keya Sheet Hair Oil (5.7%), Shisha Hair Oil (5.1%), Valsine Hair Oil (5.1%), Hash Marka Coconut Oil (4.2%), and Vatika Dabour Coconut Oil (4.0%).

-

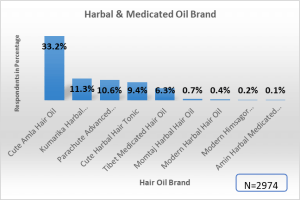

Harbal & Medicated Oil Brand

To identify the top branded Harbal & Medicated Coconut Oil products, we have asked the respondents (total of 2974) about the most selling natural coconut oil brand names. A total of 33.2% of 2974 respondents mentioned “Cute Amla Hair Oil” as the top brand and Amin Herbal Medicated Oil as the tenth (0.1%) among the top ten brands of hair oil. The other brands are; Kumarika Harbal Hairfall Control (11.3%), followed by “Parachute Advanced Ayurvedic Oil (10.6%), and Cute Herbal Hair Tonic (9.4%).

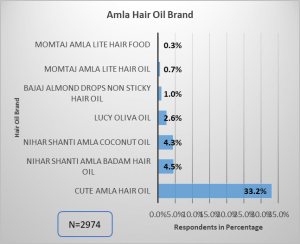

- Amla Hair Oil Brand

To identify the top branded Amla Hair Oil products, we have asked the respondents (total of 2974) about the most selling Amla Hair Oil brand names. Approximately 33.2% of the total respondents mentioned “Cute Amla Hair Oil” as the top brand and Momtaj Amla Lite Hair Oil as the last (0.3%) among the top Amla brands of hair oil. The other brands are; Nihar Shanti Amla Badam Hair Oil (4.5%), Nihar Shanti Amla Coconut Oil (4.3%), Lucy Oliva Oil (2.6%), Bajaj Almond Drops Non-Sticky Hair Oil (1.0%) and Momtaj Amla Lite Hair Oil (0.7%).

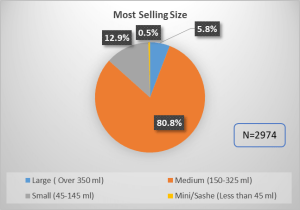

- Most Selling Size:

We recently surveyed 2,974 individuals to determine the most popular size of hair oil in the market. As a result, the majority of respondents (80.8%) prefer medium-sized bottles (between 150-325 ml), followed by small bottles (between 45-145 ml) at 12.9%. Large bottles were preferred by 5.8% of respondents, while mini/share sizes were preferred by only 0.5% of respondents.

Report Summary

In conclusion, this research report collected primary data from 25 districts, 69 upazilas, and over 250 bazaars/PSUs across Bangladesh. To ensure comprehensive coverage, we included rural bazaars, hats, and PSUs to capture diverse geographic perspectives. After completing the fieldwork, the questionnaires were reviewed by a highly experienced team at PRITI, who checked and coded them carefully. Furthermore, the data-checking team randomly selected at least 15% of the questionnaires for additional review to ensure accuracy and validity. Once all data were checked, scrutinized, coded, and backchecked, we obtained a reliable and valid dataset. Overall, these steps helped ensure that our results are both robust and trustworthy.

About Us

PRITI is the abbreviation of Participatory Research & Innovative Technical Initiatives. PRITI is an output of combined efforts where young energetic, highly experienced, and nationally leading sector. We have several research products & consultancy services for corporate companies, products & service base companies, national & international NGOs, donor agencies, international aids, Govt. Our Consultancy Service has been selected as an execution vendor for the proposed study.

For more details, please Contact Us.

or, WhatsApp Us: +880 1713222363