Bangladesh, with its vision of becoming a “Smart Bangladesh” by 2041 is rapidly embracing digital banking. The country’s economy boasts a robust GDP growth rate of 7.1%. The recent expansions in digital penetration have set the stage for transformative changes. However, challenges remain, particularly in reaching the unbanked population. Let’s explore the dynamic world of digital banking in Bangladesh, including its necessity, regulatory framework, market participants, technological foundations, challenges, and effects on financial inclusion.

Digital banking refers to the transmission of banking services through digital channels, such as the Internet and mobile phones. It allows customers to establish and access their bank accounts, make payments, transfer funds, access credits, and utilize card facilities without visiting a physical branch.

Digital banking refers to the use of online and mobile platforms for baking services. Let’s break it down:

- Online Banking: This involves accessing banking features and services through your bank’s website on a computer. You can check your account balance, pay bills, and even apply for loans or credit cards—all without leaving your home. It’s like having a virtual branch at your fingertips.

- Mobile Banking: Mobile banking takes things a step further. It’s all about using mobile apps on smartphones or tablets to perform banking tasks. These apps are provided by your bank and offer features like mobile check deposits, fund transfers, bill payments, and even peer-to-peer payments through services like Zelle. Additionally, banks use mobile apps to send alerts, such as fraud detection notifications.

Scope of Works of Digital Bank

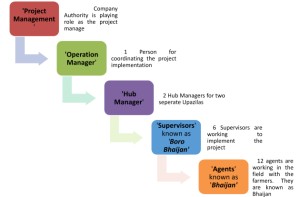

As per the above discussion on Bangladesh’s Socio-Economic conditions, the proposed Digital Bank can work in multi-various sectors as an economic key driver & finance stakeholder. The major sectors are as follows:

Mobile Financial Services

Mobile Financial Services (MFS) is an approach to offering financial services that combines banking with mobile wireless networks which enables users to execute banking transactions. This means the ability to make deposits, withdraw, and to send or receive funds from a mobile account. Often these services are enabled by the use of bank agents that allow mobile account holders to transact at independent agent locations outside of bank branches. Following several years of deliberations and ad hoc permissions on MFS, the Department of Currency Management and Payment Systems of Bangladesh Bank issued “Guidelines on Mobile Financial Services (MFS) for the Banks” on 22 September 2011 which were subsequently amended on 20 December 2011.

Current Status of MFS Services & Its Providers

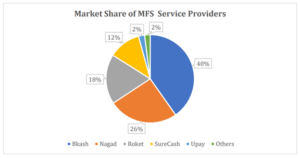

A total of 13 MFS service providers exist in the market who are providing financial services to customers. Presently, the list of the current MFS service providers is as follows:

| Sl. No | Name of the MFS Service | Name of the Business Entity |

| 1 | ROCKET | Dutch Bangla Bank Ltd. |

| 2 | bKash | BRAC Bank |

| 3 | MyCash | Mercantile Bank Ltd. |

| 4 | Islami Bank mCash | Islami Bank Bangladesh Ltd. |

| 5 | Trust Axiata pay: tap | Trust Axiata Digital Ltd. |

| 6 | FSIBL FirstPay | First Security Islami Bank Ltd. |

| 7 | Upay | UCB Fintech Company Ltd. |

| 8 | OK Wallet | One Bank Ltd. |

| 9 | Rupali Bank | Rupali Bank Ltd. |

| 10 | TeleCash | Southeast Bank Ltd. |

| 11 | Islamic Wallet | Al-Arafah Islami Bank Ltd. |

| 12 | Meghna Pay | Meghna Bank Ltd. |

| 13 | Nagad | Bangladesh Post Office (with interim approval of BB) |

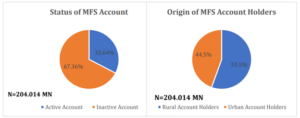

Current Subscribers of MFS Accounts

Accordingly the Bangladesh Bank data (April 23), there are total number of MFS subscribers is about 204.014 MN where 66.581 MN are active & 137.433 MN accounts are current inactive. Among the total subscribers, 55.5% are rural & 44.5% are urban subscribers. On the other hand, among the total subscribers, 57.9% are male & 42.1% are female subscribers.

Current MFS services in Bangladesh

The swift integration of financial technology is ushering in a new era of inclusivity within Bangladesh’s finance sector. Presently, financial and banking services have become accessible to individuals from virtually every corner of the nation. These services can be conveniently availed from any location, provided the user possesses a mobile device or internet connection. This remarkable progress owes its credit to the dedicated Mobile Financial Service (MFS) providers, who consistently achieve remarkable milestones within the economy.

During the preceding fiscal year (FY22), the MFS industry witnessed a remarkable 30.34% surge in transactions, culminating in an outstanding total of Tk. 9,90,004 crore. Notably, the month of April 2022 alone witnessed transactions worth Tk. 107,460 crore via MFS. Furthermore, a significant 25% of adult residents in Bangladesh now utilize MFS and online banking services for making utility bill payments. Bangladesh Bank reveals that a substantial 178.6 million mobile accounts have been successfully registered for MFS.

It is evident that MFS providers have been actively reshaping the country’s financial landscape over an extended period. As a gesture of acknowledging their accomplishments, we are pleased to introduce you to the prominent Mobile Financial Service (MFS) providers operating in Bangladesh today.

Top Mobile Financial Services (MFS) Providers in Bangladesh

Bangladesh has several mobile financial service providers that cater to making the transaction of money as seamless as possible. Among them, here are the top 12 MFS providers in Bangladesh:

Current Status of Digital Banking in Bangladesh

In June 2023, Bangladesh Bank, the nation’s central bank, approved a guideline on digital banking in Bangladesh following years of examination. Considering the substantial demand from the supply side as well as the consumer side, this action was imperative. 52 domestic and international entities have already applied for licenses to establish digital banks, exceeding the initial goal of only two or three organizations being granted licenses. Among these candidates are:

- Traditional Banks: Entities like City Bank, Mutual Trust Bank (MTB), Eastern Bank Limited (EBL), Dutch Bangla Bank Limited (DBBL), National Credit and Commerce Bank (NCCB), Mercantile Bank, and Midland Bank.

- Mobile Financial Services (MFS) Companies: Bkash and Nagad.

- Ride-sharing companies: Financial Institutes, Microcredit Companies, E-commerce Platforms, Telecom Operators, IT Service Providers, and even Pharmaceutical Companies.

According to the BB guidelines for the establishment of a Digital Bank, Bangladesh Bank (BB) in principle decided to go with the pace of global banking and payment service by adopting Fintech and digital solutions emerging around the globe to attain the objectives of Sustainable Development Goals (SDGs) and National Financial Inclusion Strategy (NFIS). Moreover, BB is envisaging the challenges of the 4th Industrial Revolution (4IR) by pondering, an alternative to the traditional brick-and-mortar model of banking system to the customers.

Bangladesh Bank already permitted all scheduled banks to provide different alternate delivery channels, Mobile Financial Services (MFS), and other e-wallets digital solutions to facilitate access to finance for the mass people & all over the end-level consumers. Also, the Bangladesh Bank is recognizing the role of digital platforms in driving greater efficiency in the delivery of financial products & services and expanding low-cost access to finance for the unserved and underserved market segment.

Although there are a few challenges to running the digital bank fully across the country due to some national, regional, social & cultural barriers it is surely a good initiative to move forward with advanced & digital banking systems which will open a new era of the digital banking industry in Bangladesh.

For more, Please Contact Us…